The US dollar has fallen to its lowest level in nearly four years, triggering renewed debate across global financial markets. The decline comes at a time when former US President Donald Trump has publicly insisted that the American currency is “doing great,” creating a sharp contrast between political messaging and market reality.

The weakening of the dollar has caught the attention of investors, policymakers, and economists worldwide, as the greenback plays a central role in global trade, commodities, and financial stability. The latest move signals shifting sentiment around the US economy and future monetary policy.

Dollar Hits Multi-Year Lows

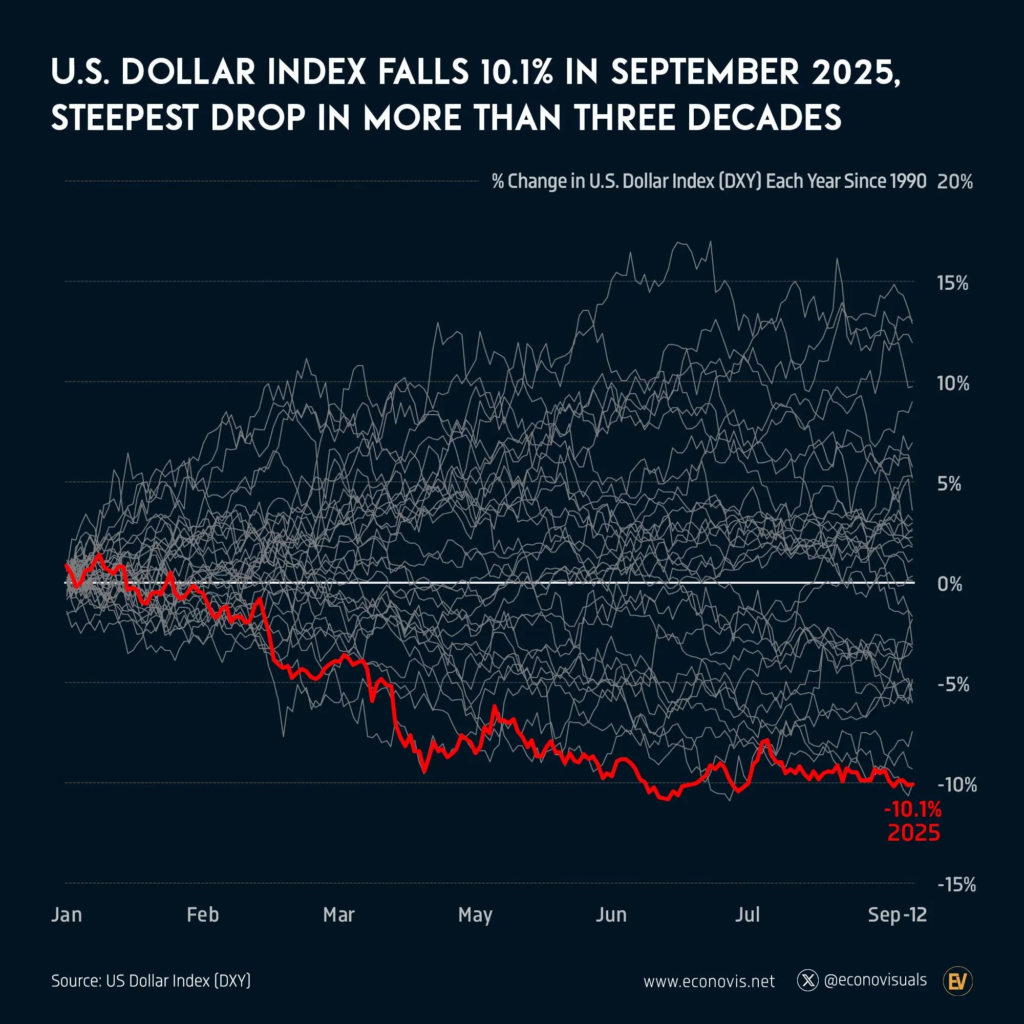

The fall in the dollar is reflected clearly in the US Dollar Index, which measures the greenback against a basket of major currencies including the euro, yen, and pound. The index has slipped to levels last seen around 2021–22, marking a significant reversal from the dollar’s earlier strength.

Currency traders say the decline is not the result of a single factor but rather a combination of economic expectations, policy uncertainty, and changing global risk appetite. As confidence shifts, investors have gradually reduced their exposure to the dollar in favor of other currencies and assets.

Trump’s Optimistic Assessment

Despite the market slide, Donald Trump dismissed concerns about the dollar’s weakness, stating that the US currency remains strong and is performing well. His remarks suggest that he views a softer dollar as manageable and possibly even beneficial for the American economy.

Trump has historically supported the idea that a weaker dollar can help US exporters by making American goods cheaper overseas. However, critics argue that sustained weakness could also signal deeper economic issues and reduce global confidence in the US financial system.

What Is Driving the Dollar Lower?

Several key factors are contributing to the dollar’s decline:

1. Interest Rate Expectations

Markets increasingly expect the Federal Reserve to move toward interest-rate cuts in the coming months. Lower interest rates generally make a currency less attractive to investors seeking higher returns, leading to selling pressure on the dollar.

2. Fiscal and Debt Concerns

Rising government spending and a growing national debt have added to worries about the long-term strength of the US economy. Investors tend to become cautious when fiscal discipline appears uncertain, which can weaken a country’s currency.

3. Global Diversification

Many central banks and large institutions are gradually diversifying away from heavy reliance on the US dollar. While the dollar remains dominant, even small shifts in reserve allocation can have noticeable effects on currency markets.

4. Political and Policy Uncertainty

Unclear signals on trade, taxation, and economic policy have also played a role. Currency markets prefer stability, and mixed messaging from political leaders can increase volatility.

Impact on Global Markets

A weaker dollar has wide-ranging effects beyond the United States. As the greenback falls, other major currencies such as the euro and yen have gained strength. Emerging market currencies have also seen some relief, as dollar-denominated debt becomes easier to manage when the US currency weakens.

Commodities priced in dollars, especially gold, often benefit from a falling greenback. Gold prices have shown upward momentum as investors look for safe-haven assets amid currency uncertainty.

Pros and Cons of a Weaker Dollar

The decline in the dollar is not entirely negative. In fact, it brings both advantages and risks.

Potential Benefits

- US exports become more competitive in international markets

- American multinational companies can earn higher profits when foreign earnings are converted back into dollars

- The trade deficit may narrow over time

Potential Risks

- Imports become more expensive, increasing costs for consumers

- Inflationary pressures may rise if higher import prices pass through to retail goods

- Long-term confidence in the US economy could weaken if the trend continues

What Analysts Are Watching Next

Market participants are now closely monitoring upcoming economic data, including inflation numbers, employment reports, and signals from the Federal Reserve. Any indication of faster-than-expected rate cuts could push the dollar even lower, while stronger economic data may help stabilize it.

Analysts also believe that political developments will remain a key factor. Statements from influential leaders like Donald Trump can influence short-term sentiment, but ultimately, currency markets tend to follow economic fundamentals rather than rhetoric.

Outlook Ahead

While Trump’s assertion that the dollar is “doing great” reflects confidence, markets appear to be telling a more cautious story. The dollar’s slide to a four-year low highlights growing uncertainty about the direction of the US economy and monetary policy.

For now, the greenback remains the world’s most important currency, but its recent weakness serves as a reminder that even dominant financial systems are sensitive to policy signals, investor confidence, and global economic shifts.

Hindustan Trends will continue to track developments in global currency markets as investors assess whether the dollar’s fall is a temporary correction or the beginning of a longer-term trend.